On March 27, the federal government unanimously approved a $2.2 trillion stimulus package that includes funds to grease the cogs of an American economy halted by the coronavirus pandemic. The benefits extend to everyone from individual citizens to huge corporations. Here’s a breakdown of what the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) means for you.

Direct checks to Americans

The biggest headline out of the CARES Act is also its largest allocation of money: direct payments to every American with a Social Security number.

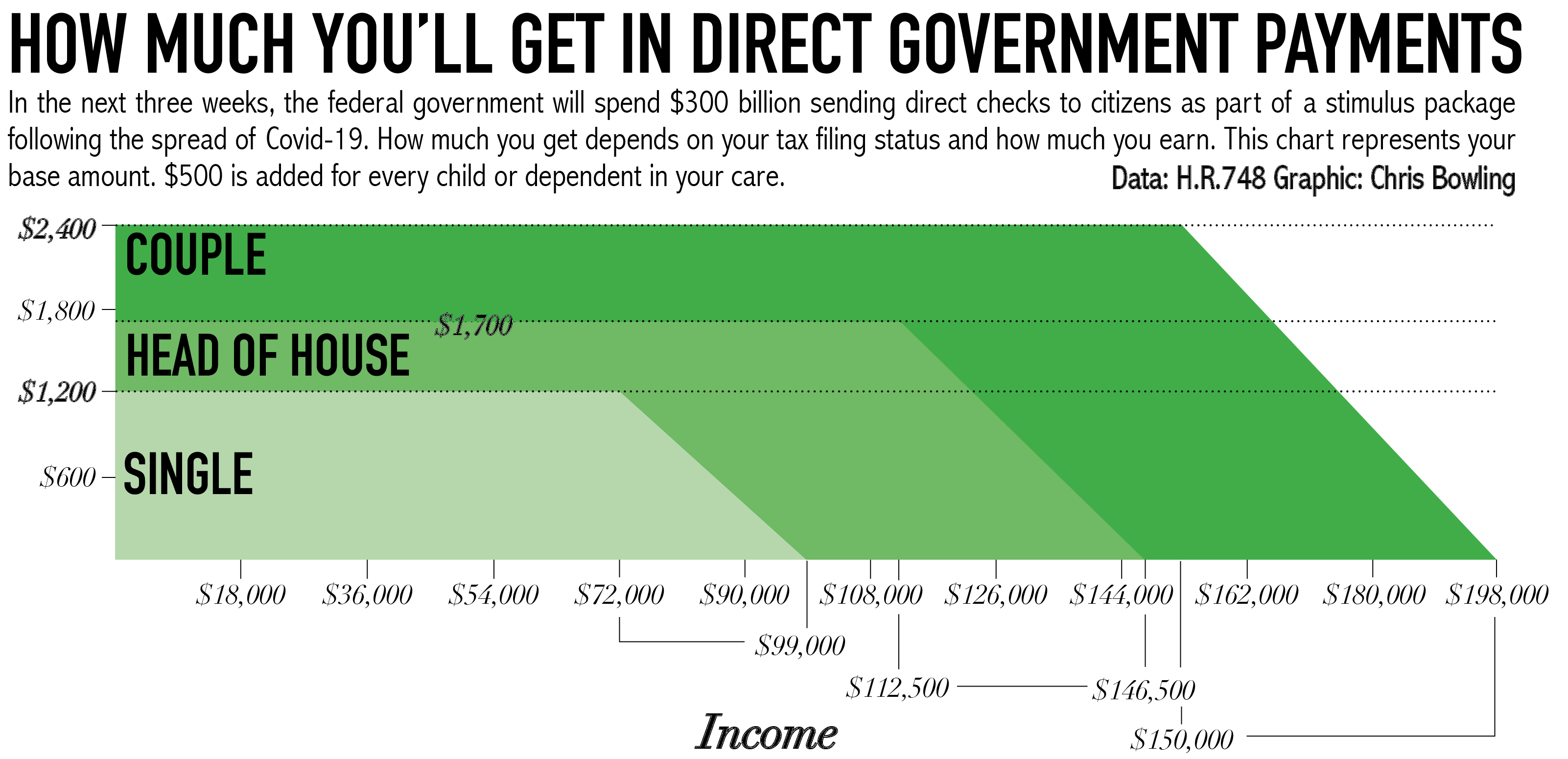

The credit will come in the form of a check up to $1,200 for individuals and $2,400 for couples who file jointly. An additional $500 is added for each child in your care.

Individuals making $75,000/year will receive the full amount along with couples filing jointly and making less than $150,000. Individuals making over $99,000 or couples making more than $198,000 will not receive a payment.

The earning limit is $112,500 for heads of household, meaning you pay for more than half a household’s expense and claim one dependent.

You will also not receive a payment if anyone claims you as a dependent which includes many high school seniors and college students. In addition families will not receive money for children 16 years or older.

Information on your earnings is pulled from either your 2018 or 2019 tax returns. If you receive social security but do not file tax returns, you will be asked to file a “simple” return. More information on that will be made available on the IRS’s website.

This program does not assist people whose incomes have changed drastically since filing their last tax return. It may benefit them after filing in 2020 but for immediate assistance their best avenues would be filing for unemployment, if applicable, or for different loans.

When will I get my check?

On Monday, March 30, the IRS said it will begin depositing checks within three weeks. So presumably by April 20 many citizens should have their deposit.

Most Americans won’t have to do anything. The IRS will use their latest tax return to estimate the amount to send and then directly deposit it to their bank account.

If the IRS does not have your direct deposit information or you’ve switched banks since filing, the agency will have an online portal for you to provide that.

Those who don’t normally file a tax return will have to fill out a “simple” version to receive their check. It seems that will require similar info to a normal tax return but more information on how and where to fill that out will be made available on IRS.gov/coronavirus.

The step came as a shock to lawmakers and advocates who believed there would be no extra steps for the more than 15 million Americans who receive Social Security benefits and do not file returns.

In 2008, 3.5 million Social Security recipients missed out on stimulus checks after they failed to file a return.

This credit will remain available throughout 2020. So if you’re a person who needs to take additional steps to receive your credit, don’t worry as the IRS has provided a wide window for you to access information and ask questions.

Unemployment benefits

Direct checks are slated to cost $300 billion. The remaining $260 billion for individuals will fund extra unemployment benefits. That amount is subject to change depending on how many people file for unemployment over the next few months.

Here are some of the key things it adds or expands:

- Adds $600 per week of federal dollars to all people receiving unemployment benefits, even those who applied before the rush of Covid-19 cases. In Nebraska, someone earning 2020’s weekly cap of $440 can now earn $1,040. (Nebraska pays half the average weekly wage of your highest earning quarter so a $440 check would mean you normally made $880 in a week).

- Expands benefits to workers not typically eligible for benefits. Those include freelancers, contractors, self-employed people and gig workers. They’ll get paid between $174 and $440 per week through the federal government, on top of the $600 per week boost. That program lasts until July 31.

- Extends benefits an additional 13 weeks past the typical 26-week timeframe. After state benefits run out, workers will continue to collect $600 per week.

The application for unemployment benefits will remain the same, said Grace Johnson, public information officer with the Nebraska Department of Labor. Nebraska is still implementing these federal changes to its program but those receiving benefits should expect to see a check with federal and state dollars soon.

Help for Small Businesses

Originally posted on Pioneer Media’s blog.

Things are moving fast and it can be confusing for business. Anyone that tried to initially apply for a SBA Disaster Loan endured an online system crashing, only to be replaced by a file upload feature for PDF documents without any quick response or follow-up.

That seems to be changing and every organization under 500 employees, for-profit and non-profit, impacted by the COVID-19 pandemic should consider applying now for an Economic Injury Disaster Loan to get an Emergency Economic Injury Grant for $10,000 be paid within 3 days. Additionally, there are some other programs you need to consider next.

Emergency Economic Injury Grant

On March 30, the Small Business Administration notified businesses that had previously set-up an online account for disaster relief loans that there was an “opportunity to get up to a $10,000 Advance on an Economic Injury Disaster Loan (EIDL). This advance may be available even if your application was declined or is still pending.” A decision is promised within 3 days, but payouts might take longer.

If you’re interested, fill out this quick form. It only takes minutes. Beside your basic identifying business and personal information, be prepared to answer the following:

• Gross Revenues for the Twelve(12) Month Prior to the Date of the Disaster (January 31, 2020). This should be your top line sales receipts

• Cost of Goods Sold for the Twelve(12) Month Prior to the Date of the Disaster (January 31, 2020). Based on a SBA training PDF, you can calculate this using the following definition: Total expenditure for inventory items which customers buy. Cost of Goods Sold consists of the cost of purchasing the items, freight, manufacturing costs, modification costs, and packaging. For services, this is the cost of providing the services, including labor, material used, and transportation

• Your bank’s routing number and your bank account number. TIP: If this last screen has you stuck, double-check for a red bar next to a required field. For the bank account number, one applicant had to enter zeroes before the actual account number until the red bar turned green, then was able to complete the application.

By completing this application, you have also started the process for an Economic Injury Disaster Loan. If you tried before, that’s okay. You don’t have to accept the loan, but at least you’ll have the option if you need it.

While more information is expected from the SBA, possibly daily, for now one of the leading guidances on the CARES Act appears to be the The Small Business Owner’s Guide to the CARES Act from Senator Ben Cardin (D-Md.) and the U.S. Senate Committee on Small Business and Entreprenuership. Here’s some highlights:

Economic Injury Disaster Loans (EIDL)

The $10,000 advance at the top of this article is part of the SBA’s Economic Injury Disaster Loan program and according to the guide: ” may be used to keep employees on payroll, to pay for sick leave, meet increased production costs due to supply chain disruptions, or pay business obligations, including debts, rent and mortgage payments.”

Based on previous requirements, these are loans up to $2 million at lower interest rates and repayment terms of up to 30 years.

Paycheck Protection Program (PPP)

This is the program that can turn a loan into a grant for 8 weeks of payroll, mortgage/rent and utilities. NOTE: Just because there is a grant opportunity here, cash flowing employees who don’t have work to perform still creates an initial outlay and compliance work for your business. With the recent expansion of unemployment benefits, many employees will have a chance to made whole on their income for up to 9 months.

These loans run through an approved SBA 7(a) lender — jump to page 30 of this PDF — to see lenders in Omaha, NE.

Here’s the short explanation, ” 100 percent federally guaranteed loans to employers who maintain their payroll during this emergency. If employers maintain their payroll, the loans would be forgiven, which would help workers remain employed, as well as help affected small businesses and our economy snap-back quicker after the crisis.

PPP has a host of attractive features, such as forgiveness of up to 8 weeks of payroll based on employee retention and salary levels, no SBA fees, and at least six months of deferral with maximum deferrals of up to a year,” according to the guide. Here’s key details:

• Retroactive to Feb. 15, 2020, available through June 30, 2020

• Any business under 500 employess, including nonprofits, independent contractors and eligible self-employed individuals

• Loan size determination

- If you were in business February 15, 2019 – June 30, 2019: Your max loan is equal to 250 percent of your average monthly payroll costs during that time period. If your business employs seasonal workers, you can opt to choose March 1, 2019 as your time period start date.

- If you were not in business between February 15, 2019 – June 30, 2019: Your max loan is equal to 250 percent of your average monthly payroll costs between January 1, 2020 and February 29, 2020.

• If you took out an Economic Injury Disaster Loan (EIDL) between February 15, 2020 and June 30, 2020 and you want to refinance that loan into a PPP loan, you would add the outstanding loan amount to the payroll sum

• Costs not eligible include employee/owner compensation over $100,000 and qualified sick and family leave from Families First Coronavirus Response Act

• Forgiveness on a covered loan is equal to the sum of payroll costs incurred plus mortgage/rent or utilities during the covered 8 week period compared to the previous year or time period. Application for forgiveness will be made through the lender institution

• Any loan amounts not forgiven are carried forward as an ongoing loan with max terms of 10 years, at a maximum interest rate of 4%, slightly higher than an EIDL. Principal and interest will continue to be deferred, for a total of 6 months to a year after disbursement of the loan. The clock does not start again.

• You will likely need the advice of an attorney and a CPA to process an application for forgiveness. Please consult with a professional before completing a PPP application.

Stay tuned and we’ll continue to update this post as we receive more guidance.

Other compensation

Other recipients of funds through this act includes more than $100 billion for healthcare. Hospitals will receive the lion’s share with about $100 billion. Additional funding will go to community health centers, veteran healthcare, supply stockpiles and drug development and expanded access.

Major corporations will also about $500 billion in loans and other funds. Airlines alone will receive about $58 billion in loans. Repayment of these loans will be publicly disclosed. The law also establishes an inspector general position, as well as a committee, to oversee funds and tax dollar expenditures related to the law.

Another $339.8 billion will go to state and local government, mostly to help directly with efforts to fight Covid-19. Additional dollars will go toward community black grants as well as schools, higher education and child care centers.

Additional funding for education will defer student loan payments until Sept. 30 without penalty to the borrower.

Finally, about $26 billion will fund food security programs including food banks, the Supplemental Nutrition Assistance Program and schools to continue providing food for students even with classes canceled.